After the Securities and Exchange Commission (SEC) approved the registration request for ProShares’ Bitcoin futures ETF on Friday (October 15), the Bitcoin price surpassed $62,000 for the first time in six months.

Although it was widely expected that one or more Bitcoin ETFs would be approved by the SEC next week, Bloomberg Intelligence ETF Analyst James Seyffart was among the first to notice that the ProShares Bitcoin Strategy ETF (ticker: NITO) had been approved by the SEC. He tweeted around 13:54 UTC yesterday that information about this ETF (ticker: NITO) was being added to the Bloomberg Terminal and also pointed out that Valkyrie Investments.

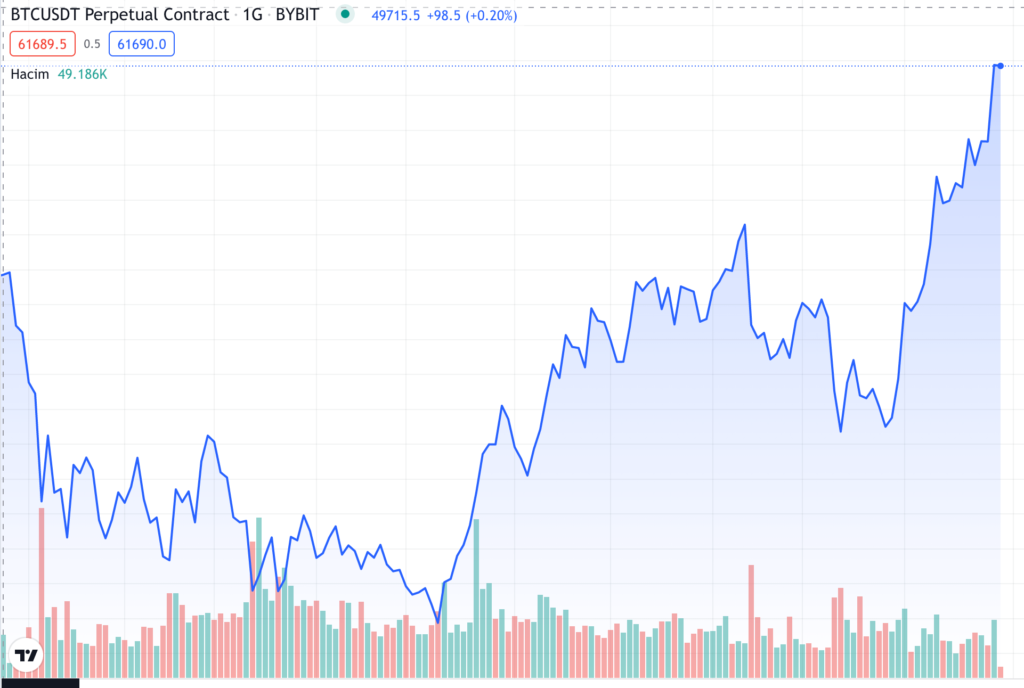

According to TradingView data on crypto exchange Bitstamp, around one and a half hours later, the Bitcoin price, which was trading around $59,700 at the time, began surging toward the $60,000 level and beyond, and by 20:24 UTC (on October 15), the $BTC price had reached $62,676, which was yesterday’s intraday high and just $888 shy of Bitcoin’s all-time high ($63,564), which was recorded on April 13.

Currently (as of 09:30 UTC on October 16), Bitcoin is trading around $61,532, which means that in the past one-month period, BTC-USD is up 28.29%.

According to a story published yesterday by CNBC, NYSE Arca, the primary U.S. exchange for the listing and trading of ETFs, will “enable investors to trade the funds as permitted by federal law without SEC involvement.” It also stated that “a person familiar with the SEC’s decision-making emphasized that the ETF will be allowed to begin trading next week, barring any last-minute regulatory objection.”

Athanasios Psarofagis, another Bloomberg Intelligence ETF analyst, predicted that broad commodity indexes/ETFs, such as WisdomTree Enhanced Commodity Strategy Fund (NYSEARCA: GCC), would soon begin allocating to Bitcoin futures, and, interestingly, a few minutes later, his colleague revealed that the aforementioned ETF had decided to allocate 5% to Bitcoin futures ETFs.

Finally, Inveso’s Bitcoin Strategy ETF is set to launch (and begin trading) next week as another Bitcoin futures ETF.

Christian Prichard

November 6, 2021 at 4:21 pm

I got this site from my pal who told me regarding this website and at the moment this time I am browsing this site and reading very informative articles at

this time.